Insurance technology startups have been on a declining trend globally, but there has been an increase in AI-focused and pre-seed investments, with the United States maintaining its leadership by securing half of these.

That is according to the Insurance State of Insurtech 2024 Report by CB Insights, which provides a detailed analysis of global trends, investments and exits in the insurance technology sector.

The report highlighted a decline in investments in insurtech startups, record levels of early-stage investments and notable regional differences.

While no venture or investment from Türkiye stands out, developments in the U.S., Europe and Asia are particularly noteworthy.

In 2024, global investments in the insurtech sector decreased by 28% compared to the previous year, with deal count dropping to 362 deals. This marks the lowest level seen since 2016. The total investment amount fell 4% year-over-year to $4.5 billion.

Record early-stage investments

Investments in the property and casualty (P&C) insurance segment showed a significant decline. In the last quarter of 2024, property and casualty insurance startups received only $400 million in investments, reaching a seven-year low.

The median amount for early-stage investments increased by 52%, reaching $3.8 million. This is ahead of the general trend in the venture capital ecosystem.

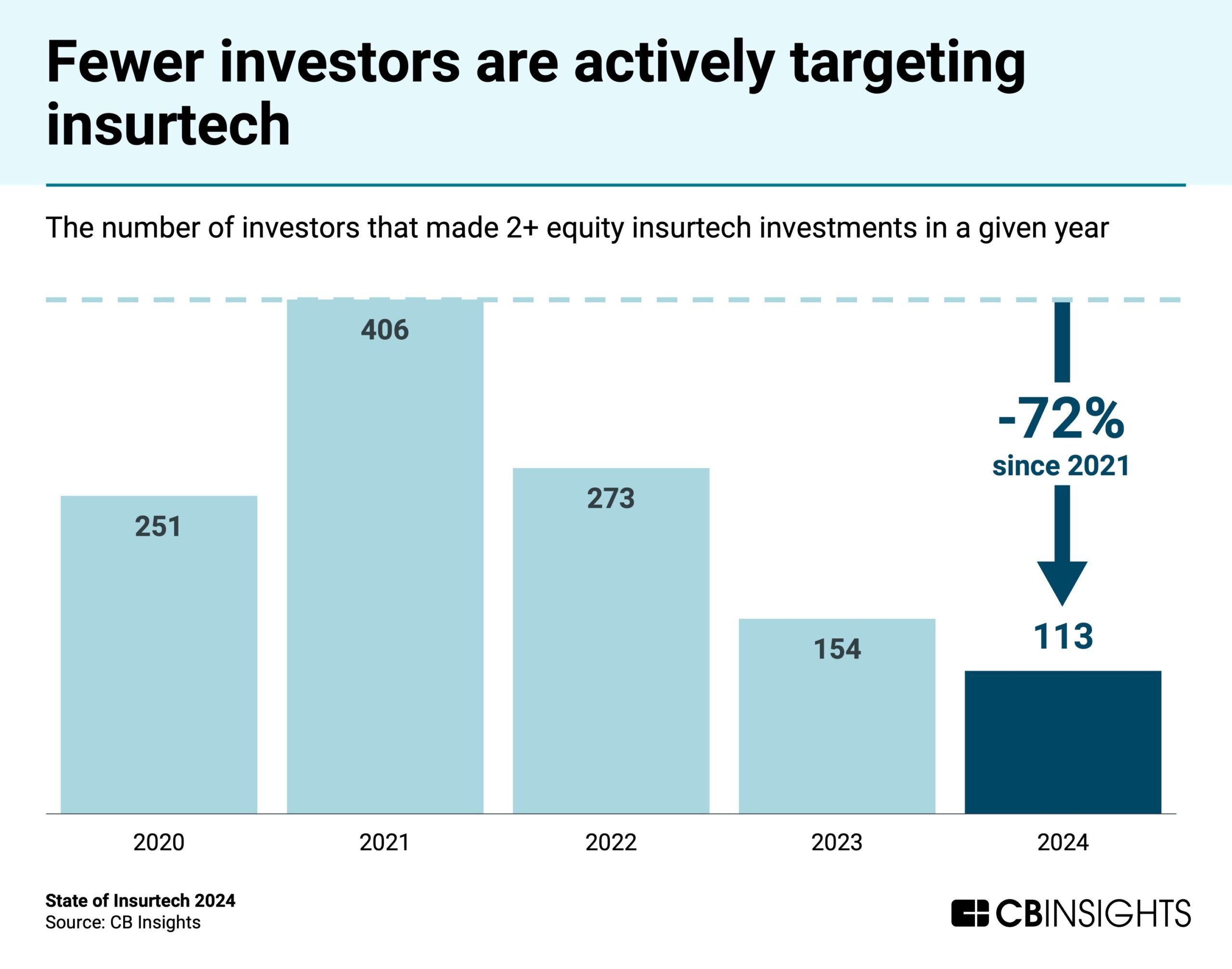

The number of investors decreased from 57 in 2021 to just seven in 2024, indicating a significant decline in interest in the sector.

Exits for insurtech startups also declined in 2024.

Mergers and acquisitions dropped from 57 in 2023 to 35. Only two initial public offerings (IPOs) were made, showing that investors are becoming more cautious about their exit strategies.

Silicon Valley’s decline

In 2024, Silicon Valley’s share of global insurtech investments dropped to 10%, down from 20% in 2023. In contrast, New York emerged as a leader, capturing 15% of insurtech investments.

Considering Silicon Valley’s dominance in the AI field, this decline could result in missed opportunities in AI-driven insurance developments.

The U.S. maintained its leadership by securing 50% of global insurtech investments. Europe followed with a 23% share.

Startups from India, such as SarvaGram and Zopper, attracted attention with large investment rounds. SarvaGram secured the largest investment of 2024 with a $67 million Series D round.

The report did not highlight any insurtech venture or investment from Türkiye, indicating that the country’s insurance technology ecosystem has yet to attract global investors’ attention. However, considering the increasing activities of fintech and insurtech startups in Türkiye in recent years, more investments and growth in this area are expected in the coming years.

New hopes

Last year marked a turning point for the insurtech sector. Despite the decline in investments, AI-focused solutions and early-stage investments hold promise for the industry’s future.

The largest investments in 2024 were directed toward AI-focused startups. Companies offering AI-based solutions, such as Aitana AI and Akur8, attracted significant investor interest. This shows that AI is playing an increasingly critical role in the insurance sector.

For Türkiye to attract more investments in this area, it needs to focus on innovative ventures and international collaborations.

Although no venture or investment from Türkiye was highlighted in the report, successes in the fintech sector offer a promising foundation for the insurtech industry. It is expected that insurtech startups from Türkiye will make their mark on the global stage in the coming years.

2024 investment highlights

• The lowest investment deal count since 2016.

• 362 global insurtech deals completed.

• Total global investment reached $4.5 billion.

• $400 million in P&C insurtech investments (seven-year low).

• $3.8 million median early-stage investment amount (record level).

Turkish AI-backed data analytics platform lowers error margin in target predictions

B2Metric, an artificial intelligence-based analytics solution provider for institutions, remains among the startups that graduated from Türk Telekom’s startup acceleration program, Pilot, and received investments from its venture capital arm, TT Ventures.

Founded in 2018 by Murat Hacıoğlu and Tuna Sönmez, B2Metric operates in the field of artificial intelligence and is one of the startups TT Ventures has invested in with a focus on AI.

The company offers an AI-based analytical solution that provides customer journey predictive analytics, risk scoring, customer movement prediction, segmentation, and campaign and price optimization process management. It delivers high accuracy and prediction rates.

Big data analytics

B2Metric offers platforms specialized in AI-based active learning adaptive big data analytics systems in structured and unstructured scattered big data environments.

By interpreting companies’ data and making future predictions, B2Metric achieves successful results in various fields such as finance, insurance, telecommunications, digital applications, e-commerce, automotive, retail and mobile gaming.

B2Metric is among the graduates of the sixth-term Pilot startup acceleration program.

Organizations redesign processes with artificial intelligence

The world is discussing not only digital transformation but also the reality of artificial intelligence transformation, according to the Türkiye manager of the Canadian software company OpenText.

“We are determined to redesign information with AI,” said Zafer Akın, general manager of OpenText Türkiye.

His remarks came as OpenText, one of the top 10 software companies in the world, unveiled its generative AI solution, Aviator, at the “OpenText Summit Türkiye 2025” event held in Istanbul. Aviator allows companies to reduce costs and conduct real-time analyses.

OpenText operates in around 180 countries with approximately 23,000 employees. The company, with an office in Türkiye, differentiates itself from other global competitors, according to Akın.

“We are the largest software company with an office in Türkiye. We strengthened our presence in Türkiye three years ago by acquiring Micro Focus. OpenText Türkiye is the fastest-growing country globally. We aim to grow at least twice as much every year,” he said.

OpenText provides AI-supported IT automation solutions, cloud services, cybersecurity and information management services to companies of all sectors and sizes. Akın emphasized that the company is an essential partner in the business world.

Unleashing power of data

The Aviator solution is at the core of OpenText’s AI-focused transformation vision. It integrates AI in critical areas such as IT management, cybersecurity and information management, transforming organizations’ business processes end-to-end.

“Aviator works on generative AI models. Instead of providing our clients with a heap of data, we offer strategic information that guides decisions,” Akın said.

The Aviator platform enables companies to reduce costs, perform real-time analyses and optimize costs while managing risks.

“With the OpenText Aviator Database, Analytics and Intelligence, we maximize the value of various data,” Akın added.

Automation gains strength

Akın foresees that companies will enter a more controlled period in 2025. He stressed that automation and AI will become even more critical during this period.

“Interpreting data and incorporating AI into strategy will make a significant difference in making the right decisions. Managing and redesigning information is of critical importance,” he noted.

Akın pointed out that while Turkish companies allocate budgets to technology, the lack of sufficient investment in education remains a significant issue.

The event in Istanbul also saw executives from more than 20 companies across finance, banking, energy, telecommunications, logistics and public sectors discuss the benefits they gained from OpenText solutions.

Global fintech investments reach $95.6 billion

Global financial technology, or fintech, investments dropped to their lowest level in seven years, according to KPMG’s “Pulse of Fintech” report, with the market receiving a total of $95.6 billion across 4,639 deals.

The report scrutinizing global investments in financial technology showed that the Americas had the largest share, with 2,267 deals totaling $63.8 billion.

In 2024, the global payments sector continued to shine in the fintech world, receiving $31 billion in investments.

The “Pulse of Fintech” report indicated that investments in the global fintech market marked one of the lowest levels seen since 2017. The market faced a challenging year due to macroeconomic uncertainties, geopolitical conflicts and the impact of elections in many countries.

Recovery continues

Of the investments in the Americas, $50.7 billion and 1,836 deals occurred in the United States. In comparison, the Europe, Middle East and Africa (EMEA) region attracted $20.3 billion across 1,465 deals, while the Asia-Pacific region garnered $11.4 billion across 896 deals.

While global fintech investments stood at $51.7 billion in the first half of 2024, they fell to $43.9 billion in the second half, the report showed. However, quarterly data painted a positive picture as 2025 approached.

Investments rose from $18 billion in the third quarter of 2024 to $25.9 billion in the fourth quarter. Similar recoveries were seen in the Americas and EMEA regions.

The Americas received $31 billion in investments in the second half, with $20.2 billion occurring in the fourth quarter. The EMEA region attracted $7.3 billion in the second half, with $4 billion in the last three-month period.